Beyond the Box – Season 1 – Episode 1 – Mark Birschbach – Senior Vice President of Strategic Business Innovation and Technology with National Association of REALTORS®

The Season Premiere of Beyond the Box is finally here featuring the Senior Vice President of Strategic Business Innovation and Technology with National Association of REALTORS®, Mark Birschbach!

Subscribe on Apple Podcasts: https://lnkd.in/gQdtKFF

Watch on YouTube: https://lnkd.in/gtNTt2M

Listen on Google Play:

**Will be coming to Google Play soon**

In our Season Premiere, Lynette Keyowski sits down with Mark to discuss the founding of REACH and what the NAR future has in store.

“That’s very much the goal is to have a proactive approach to innovation and how things will change over time, and ultimately where our member sits in the relationship with the consumer and to the transaction. Making sure that, as their role has to evolve over time, based on how consumer preferences are evolving over time, that they are positioned to be successful and that’s why we’re here and why we do what we do.”

Full Transcript of the Show

Lynette Keywoski – Beyond the Box Host:

We are here today

with the senior vice president of strategic business innovation and technology.

Did I get that right?

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Yes.

Lynette Keywoski – Beyond the Box Host:

Awesome, with the

National Association of Realtors, Mr. Mark Birschbach. Welcome!

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Thank

you.

Lynette Keywoski – Beyond the Box Host:

It’s great to have

you Mark. I’m really excited to have you as our very, very first guest on the

Beyond the Box podcast. We wanted to put this podcast together for a couple of

reasons. Up here in Canada, there isn’t really a voice, a commentating voice of

the real estate industry, but especially the real estate technology and capital

at that intersection. I couldn’t think of anybody better to bring on as our

first guest than you, because you’ve really been championing exactly that down

in the US on behalf of the NAR and it’s venture arm on Second Century Ventures,

which I want to hear a bit more about in a second. So, thank you for joining us

and I’d love to start right there. We’re recording this during this weird

pandemic time, so of course we’re both at home and we’ll talk a little bit

about that. But before we get there, I’d love to hear just a little bit about

your origin story. Where you sort of came from in the industry and how you

landed in the spot you are in now.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Sure,

that’s a good place to start. I actually started my career on wall street. I

was an investment banker, doing mergers and acquisitions in New York City. I

joined wall street in the late 90’s which was really the first tech boom when

we were seeing the Nasdaq 5000. So, I really gravitated towards working on

technology transaction which is when I really started to get passionate about

innovation, technology, and things like that. But I was really looking at it

from an advisory perspective, or a financial perspective, as well as a strategic

perspective. What companies made sense to combine together, create synergies,

etcetera. So, I did that for almost a decade, and then I had moved to Chicago

in the meantime, and when the financial crisis hit, our firm was really

consolidating offices back into the New York area, and I wanted to stay in

Chicago, so I actually left banking and found myself in the start-up world. So,

I actually joined a technology start-up really early stage; we hadn’t really

raised much capital, but our main product was a web marketing platform that we

were selling to realtors. So, I got my indoctrination into real estate as well

as what it was like to be a start-up tech entrepreneur. What I realized about

real estate, the really hard way, was it’s incredibly complicated, and we spend

a lot of time, a lot of capital, trying to figure out who is our customer and

how should we be targeting them and what was the difference between the

association world, and the brokers world, and how did the MLS system all play

into that. And as a tech entrepreneur, it’s incredibly challenging to figure

all of that out and to navigate through that which that, combined with it being

around 2009-2010, one of the worst real estate markets in history given what

had happened. It was really challenging for us to get that business to work,

but it really opened the door which was an opportunity for me to join the NAR

in 2013 and help launch our REACH program. So, I had a really good financial

M&A background, I had, I’ll say, dabbled in the start-up world as a

start-up entrepreneur myself, and happened to be working in the real estate

industry from a tech entrepreneur perspective. And that experience made me the

perfect fit to come work for the NAR to use those resources to help companies

be successful in this place. So, I joined NAR in 2013 when we founded and

launched the first REACH class, the first REACH program.

Lynette Keywoski – Beyond the Box Host:

Awesome, awesome.

So, tell us a little bit about REACH; it’s genesis, what the purpose was, and I

know there’s a bit of a step before REACH happened, so Second Century was to

that, which would have been before your time with NAR, but I’d love for you to

kind of weave those pieces together as well.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Yeah,

for a very large trade association to have a venture capital arm, is pretty interesting.

Pretty amazing, actually. The story of Second Century Ventures even goes a

little bit farther back when a guy by the name of Scott Fisher came to NAR in

the early 2000’s with an idea for a lockbox company. Which has now been very

successful; it’s a company wholly own called Centralock. But it was his idea to

approach the NAR and say, “I need capital to start this business. Your members

are getting price gauged by a competitor in the industry who sort of has a

monopoly in the industry.” And the NAR’s response back to him was, “Well, we’ll

promote your product, this is how much we’ll charge.” It was a marketing and

advertising relationship. And he sort of flipped it on its head and said,

“Well, no I’m looking for you to give me money to invest in my company.”

Thankfully Bob Goldberg and the senior management and leadership at the time;

this is a really interesting concept to get into at the time – to start getting

into backing companies that can help support our members. So, that was really

the first, call it, transaction that the NAR did. And what they realized

through that process was that with a lot of committees and a lot of red tape

and to get something like that through that entire system was really

challenging. And it took a really long time. If you want to be in the venture

capital business, you need to be able to move quickly. So, that was the idea

behind creating Second Century Ventures as a wholly owned subsidiary with a

separate board that could move really quickly when opportunities came to the

table. So, as part of NAR’s Second Century Initiatives in 2008 to launch the

entire association into its second century of existence, they created Second

Century Ventures which is really our venture capital arm where we take

investment dollars, or capital, and invest that into technology companies that

can help our members. So, that was launched in 2008, made its first investment

in 2009 into a company called DocuSign. Which not many people have heard of at

the time, but now many, many people are using it and have heard of it. So, that

has been a huge success story for the fund, but as it evolved over time, we

realized that we were missing out on some earlier stage companies that we could

help bring into the marketplace that could really help our members. So, when

Second Century Ventures was founded, the board had a pretty strict investment

criteria. We couldn’t invest in any company that didn’t have at least 2 million

dollars in revenue, or a significant customer base. It was a way they wanted to

manage risk associated with where they were investing their dollars. What we

realized that we were missing a lot of opportunities, so there were earlier

stage companies coming to the table and we had no vehicle to really partner

with those companies. So, we got the idea to start REACH, which is more of a

programmatic experience for typically an earlier stage company but the way it’s

evolved over the last decade now, is we actually get later stage companies, or

start-up companies with a lot of traction in other markets who really want that

programmatic experience to help launch themselves into real estate. So, it’s

really evolved over time with that very early centralack investment that

ultimately paved the way for Second Century Ventures to exist, and now REACH to

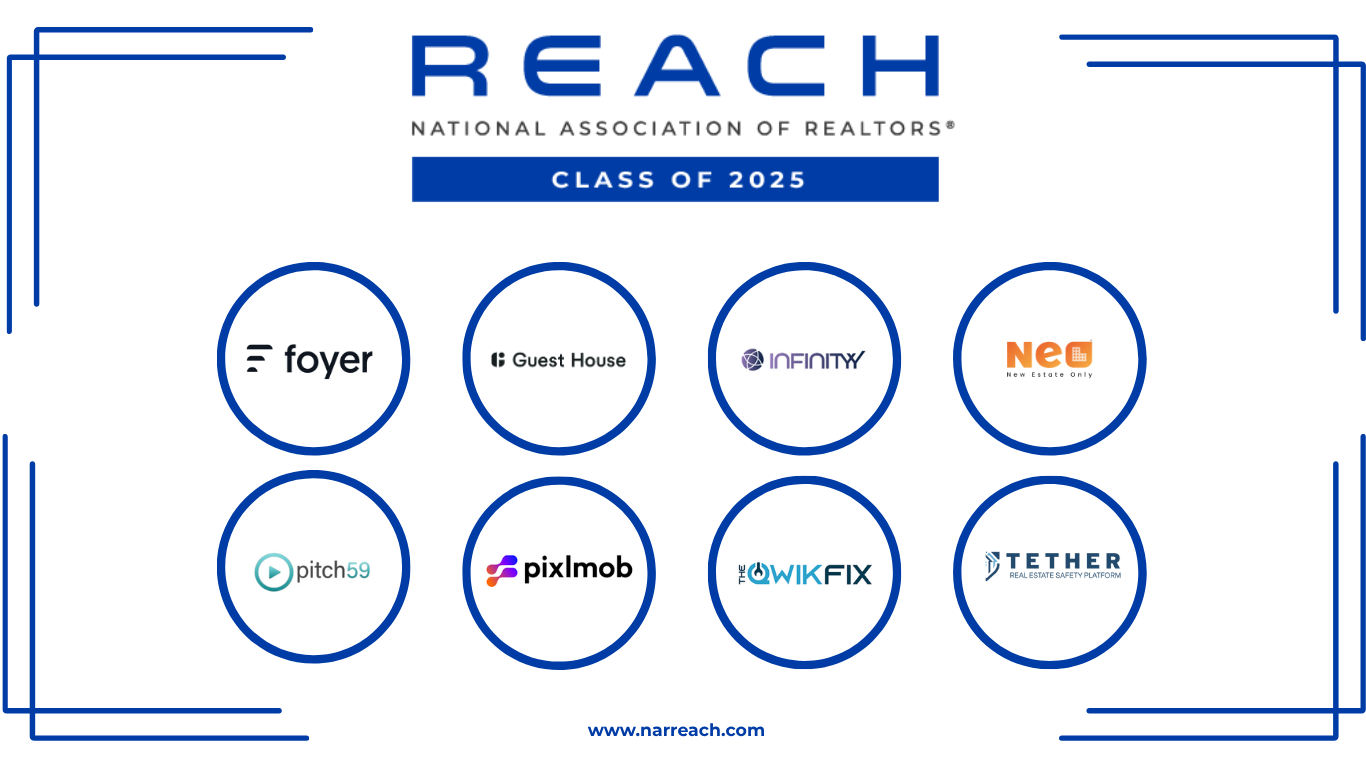

exist which, I mean we just launched our eighth core REACH class. We’ve

expanded that program significantly and it’s bringing a lot of value to the

table for our members.

Lynette Keywoski – Beyond the Box Host:

I love that you

waved the story that way. I just learned now why it’s called Second Century

Ventures, so that’s a very cool little tidbit of information to have. I know

I’ve had a lot of people ask, “Why Second Century Ventures?” so now we know!

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

I know!

Lynette Keywoski – Beyond the Box Host:

Launching realtors

into their second century, so that’s really awesome. So, the REACH program is

reaching its eighth cohort in the US, so obviously it has been an extremely

successful program. Can you give us just a few metrics around historically what

that portfolio looks like, how it’s performed, and how Second Century measures

the relative success of the program and why it continues to invest and expand?

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Yes,

absolutely. I mean, we really look at two major criteria when we’re looking at

partnering with any company. First and foremost, what is the value that it can

bring to our members. So, what products, what service, what pain point is it

trying to solve, what does the marketplace look like, how will it help our

members be more successful. That’s first and foremost the number one criterion.

Secondly, and I think them really more as 1a and 1b because they’re both very

important, is we track and measure financial success, or ROI on that

investment. It could be the greatest product in the world, but if it’s not

going to get traction, or the company isn’t going to do well financially, then

it’s not something we would put our equity or dollars behind. So, we really

look at those two criteria. In 2013 we launched our first class with seven

companies. We typically have anywhere from between seven and nine companies in

the REACH program each year. And then we’ll do follow on and investing in a

handful of companies from each of those classes, depending on how successful

they are.

Lynette Keywoski – Beyond the Box Host:

Awesome, so what is

the portfolio size of NAR, so seven to nine must be somewhere around, 70 to 80

companies that have gone through the reach program?

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

So, last

year, almost two years ago, we actually acquired a local accelerator which we

modified and turned that into our commercial program, which we just launched

our second cohort this year that our commercial technology real estate

solutions. So, if you include that portfolio that we acquired which includes

twenty-some companies, the total SCV and REACH portfolio is over 100 companies.

Lynette Keywoski – Beyond the Box Host:

Amazing. So, really

expansive traction across the up and coming tech that is supporting the real

estate sector.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

That’s

right.

Lynette Keywoski – Beyond the Box Host:

So, the other piece

that I was hoping you could talk to us a little bit about is sort of the vision

for moving forward. So, the REACH commercial program I know was an initial

opportunity to expand the original concept, but there’s also been more move to

expand, not just REACH. So, I’d love you to talk to that point and sort of in

conjunction with that, how that fits into, and I want to weave back into your

particular role, in terms of strategic business, innovation and technology, and

maybe how the REACH program is helping to check some of those boxes from an NAR

perspective.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

There’s

a lot in that. So, let me talk about REACH, first of all. So, we’ve expanded

REACH quite a bit. Significantly. We really looked at three different

strategies which are in various stages of being executed, so there’s a lot of

innovation happening around real estate and around real estate transaction and

places where we can help our members be more successful if we help innovate

those areas. So, the first strategy in which the commercial expansion really

fit into was what we call our “vertical strategy.” So, what our real estate

adjacent industries or areas which impact real estate transactions where we can

invest in, help innovate and make things easier and more productive for our

consumers as well as our members. So, think things like mortgage technology and

insurance technology and settlement services technology. And commercial real

estate technology which is actually quite a bit different from residential. So,

we include commercial as another vertical even though it is real estate

transaction focused. So, we’ve had companies who maybe were more focused on addressing

those specific verticals that have tried to, with varying degrees of success,

tried to come through the REACH core program, and we realized that we have an

opportunity too, as we expand and grow, to tailor something better for them so

that they’re getting a lot of value out of it, as well as our members are

getting a lot of value out of it. So, our first vertical is really our

commercial vertical, which we’re focused on trying to make successful. But we

are looking at other verticals for future expansion. The second major growth

area, which we’ve gotten a lot of traction in is our global expansion. So, this

really came about because we had international companies who were looking to

participate in REACH to open up their US markets. So, the very first company

that we had was a German based company which was a number one player in Europe,

that was looking to expand into the US. They opened their first office and

realized, “Wow this is a lot different than Europe. How do we figure out how to

trade the United States?” So, I was introduced into them and we had this great

opportunity to bring our first international company into the US using REACH.

Well, that sort of gave us the idea that innovation is happening everywhere,

not just in the United States, and how can we go and find international

companies that we can bring into the US that can help our US based members. And

so, what we started doing last year is we launched our REACH Global effort with

our first cohort in Australia. We had four Australian based companies come into

the US via REACH in 2017-18. So, there’s a lot of similarities to the United

States real estate market and Australia so it seemed like a natural place to

start. So, we’ve since announced that we’re going to do REACH Canada this year,

we’ll do REACH UK this year, and then obviously REACH US, with the idea that,

let’s go find innovation that’s happening everywhere and get involved in that

through these bi-lateral partnership agreements that we have with, let’s call

them sister organizations in real estate in those countries. We have a natural

connection there. And then we have significant connections in the international

technology and venture capital communities where we can go find the best and

brightest companies, run them through these, call them local programs, to those

countries and then when they’re ready to come into the US they’ve got some

traction in their own space, in their own location and we can help them do

really well in the US. And I think further down the road and now having this

portfolio of let’s call it, one hundred companies, as they saturate the US base

real estate market, maybe get into some of those additional verticals by

expanding their products and solutions across some of our vertical programs

that are looking to grow their businesses beyond the US and get into some of

these countries where we’ll already have a systematic way to launch them into

those companies like we did for them in the US. So, that was really the vision

around international expansion is, innovation is happening everywhere, and

let’s bring some of that to the table for our members.

Lynette Keywoski – Beyond the Box Host:

That’s awesome. So,

you’ve mentioned three strategies – vertical specific, global expansion, is

there a third? Or was that woven into the last?

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

There is

a third, which we are still working on and have not disclosed yet, but there is

a third strategy that we’re looking at.

Lynette Keywoski – Beyond the Box Host:

Cool. So, I hear a

second podcast coming up in the future.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Yes!

Lynette Keywoski – Beyond the Box Host:

That’s awesome. I

love that. I love that one of the things that I’ve had the opportunity to see

is sort of this global interest in the REACH program which speaks really highly

to not just the quality and the caliber of the program, but the reach of the

program around the world; Pardon the pun, but already how successful some of

those companies have become because of their participation in REACH programs.

So, I love the wider vision to sort of behold technology without borders

approach. So that there’s an opportunity you expand that value around the

world. I love that.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

And that

fits in really well with the overall strategy of the strategic business,

innovation and technology group of which Second Century Ventures are a key

piece of, but they really fit in the middle of what I call the value chain. So,

if you think just in their purest form, REACH as an early stage company, we’d

partner with them in their early stage, they grow and then maybe we invest in

them from Second Century Ventures as they grow and they start to fit into

that investment criteria. While we’ve been incredibly successful in that band

of companies, there was work to do around how about if we went up the value

chain to what we call our bay-tech initiatives. Which is what is our

conversation and relationship with some of these really large companies like

Google, Facebook, Amazon, Microsoft. You could go down the list, and how does

the NAR work with those companies to make sure that if they want to do

something in real estate, that they do it in a way that is beneficial to our members

as opposed to detrimental. So, we really started to open up a lot of dialogue

with those companies and we’ve had a number of different avenues within how we

go about creating relationships with them, whether that’s a straight up

marketing relationship. I also oversee the realtor benefits program which is a

program where we partner with as large as fortune 100 companies that are

looking to bring a valuable product or services to our members at a discount

for our members so they can take advantage of it. You know, so there’s

marketing and advertising relationships that we can have, there’s corporate

development, so let’s look at this 100 company portfolio of yours and look at

what you’re missing and what we can fit in with what we’re doing and maybe it gives

us a toe-hold into real estate and that’s an interesting conversation to have

at the corporate development level. Then I’ll go all the way down the value

chain to the really early stage raw, pure technology. So, think of things like

Artificial Intelligence, and Machine Learning, and VR and AR.

Lynette Keywoski – Beyond the Box Host: Blockchain.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

I try to

not list that one, because it’s a little bit ahead of its time as far as having

practical applications that make sense, but we are certainly incredibly

involved in Blockchain and how it can and will potentially affect real estate.

But yes, perfect example. I have a team of emerging technologists whose sole

focus is identifying and researching those kinds of technologies and going out

and having those conversations with the people who are funding development of

that. And a lot of that funding and development is happening, yes in the

start-up world that we have a pulse on from a REACH and SCV perspective, but

there’s a lot of funding at again, big corporations or government institutions

or academic institutions that are doing a lot of research and development

around different technologies. Our goal is to be on the forefront of that, be

involved in where those conversations are happening, and thinking many steps

ahead of how this can and ultimately will affect real estate, consumers, our

members, and be early in those conversations. And a lot of those conversations

tend to really feed what we’re doing into REACH. So, you think about the

evolution of a company starts with an idea, maybe with an underlying

technology, it becomes a really early stage product that is going to evolve

over time, and maybe it gets some traction, it gets some traction in real

estate. It makes sense for that company to go through REACH, we invest in it

out of SCV, and the company is on its way. So, where I want to be is in really all

levels of the conversation from super early stage, raw technology, to all the

way to huge multibillion, even trillion-dollar big tech company. And this new

group gives us the ability to do that.

Lynette Keywoski – Beyond the Box Host:

I think it’s

amazing Mark the way you’ve sort of woven out that picture of the value chain.

I think it’s really important to know that NAR as the largest, one of the very

largest trade associations, is really positioning itself strategically and

purposefully. But also, in a very meaningful way in every aspect of what I

would call, almost that virtuous circle that you’re creating, right. So, you

know, there’s the chain concept where you invest kind of in the middle stage

and hope you can extrapolate to the end piece of the value chain, but really

what you’re doing is feeding that system, you’re really creating the entire

ecosystem, and I think shaping that entire ecosystem for the future of the real

estate practitioner for certain, but by virtue, making certain that you are

impacting all aspects of that real estate ecosystem, not just the transaction

on the ground, not just with finance and mortgage. And so, I think it really

shifts the dialogue to the real estate industry driving more of what the sector

looks like, rather than sitting back and passively accepting what the sector

becomes and then reacting to it. I think that is an amazing path forward.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

That’s

very much the goal is to have a proactive approach to innovation and how things

will change over time, and ultimately where our members sits in the

relationship with the consumer and to the transaction. Making sure that as

their role has to evolve over time, based on how consumer preferences are

evolving over time, that they are positioned to be successful and that’s why

we’re here and why we do what we do.

Lynette Keywoski – Beyond the Box Host:

Love it. So, I want

to be conscious of your time, because I just want to note, that we’re actually

recording this in the middle of the unprecedented virtual mid-year meetings for

NAR, and I know that you have a lot of things to do, so I just have to more questions.

One more question, then a “let’s leave it at that” question. So, we are

recording this during legislative week, or make your legislative meetings week

for NAR, but also the Covid pandemic. So, we can’t not address that in the

context of this conversation. So, I’d love to hear a little bit from you or

more specifically how NAR is approaching this period of time in the context of

that innovation sort of agenda, and how you think that may shift the thinking,

where you think the shifts might happen, does it impact what Second Century is

investing in? Really, wide open field here for you to address that! I think

it’s anybody’s guess, but I’d love to know what your current thinking is.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Yeah, I

mean this is obviously been a pretty significant curve ball, in any industry.

Real estate for sure. I think what its really highlighted, really in any

industry, is how can you be productive and get things done when you’re not able

to meet face to face, or you can’t be in the same room, or if you’re in the same

room, you have to be a safe distance apart. You know, we’ve been fortunate and

working really hard to follow consumer preferences for digital transactions and

eliminating a lot of the potential face to face interaction, just from a

convenience perspective. While that idea has been super charged when people

can’t meet face to face. The companies that we have invested in, over the last

5 to 6 years that do anything to try to mimic a face to face relationship or

experience digitally or virtually are getting significant traction. All of the

digital transaction tools like esignature and remote notarization and things

like that are getting significant traction because people can’t physically get

together. So, luckily, we were on the forefront with a lot of those

technologies; we already had them in our portfolio, those companies were

getting a lot of traction already just due to consumer preference in

convenience. You know, not being able to be in a place. And we’ve seen through

this, I think some of the slower to adapt those technologies or prefer those

technologies now can’t get enough of them. Because they can’t do business

without them, so I think it remains to be seen as we come out of this; what is

the new normal? I think obviously these companies were very well positioned,

for lack of a better world, take advantage of a situation like this. But I

think this will impact how business gets done in the future and the more people

get comfortable with the tools that the technology tools that they can use that

were just a convenience from a convenience perspective, are now really being

looked at as a safety perspective were well positioned. NAR is doing a lot to

help our members navigate through this. There are business challenges. There

are safety challenges, there’s regulatory and legislative challenges and we

have been working around the clock to help address all of those things for our

members.

Lynette Keywoski – Beyond the Box Host:

Awesome, very cool.

I’ve been watching it and I’ve been seeing it through all of the news channels,

how much NAR is doing to and it’s one piece we haven’t even touched on, but the

intersection of advocacy and technology and how well situated NAR is to

facilitated some of those changes that have prevented tech from evolving just

because of the regulatory barriers. Again, for another podcast! So, Mark, thank

you so much, I really, really appreciate you doing this. I think how you and

the team at NAR have set up the SCV and the REACH initiative are going to speak

volumes in the future. I am actually really excited about what this period of

time offers for those initiatives, but they will only be successful because of

the foundation that was set up. So, kudo to you and the team for doing that.

Best of luck with the rest of the legislative meetings and hopefully we see each

other face to face and in person before this time next year.

Mark Birschbach – Senior Vice President, Strategic Business

Innovation and Technology, National Association of REALTORS®:

Hopefully,

I agree. Thank you very much for having me. Happy to do it!

— End of Podcast —

Beyond the Box: Conversations with real estate executives, venture capital partners and technologists on what lays ahead for the real estate industry in a world after COVID-19.

Beyond the Box Podcast Hosts

share

Related Articles